How to set up a successful business in Ukraine

Updated on: 25.07.2025

Ukraine offers German investors and companies attractive opportunities for expansion, particularly in the IT, agriculture, renewable energy and mechanical engineering sectors, in which German companies are already successfully active. However, setting up a company in Ukraine involves a number of challenges. From choosing the right legal form and registering a limited liability company (TOV) to tax and legal regulations - without local expertise, the incorporation process can be complicated and time-consuming. It is important to know the legal requirements and bureaucratic steps necessary to successfully incorporate a company, including the need for powers of attorney and the role of legal advisors.

However, with the support of German Ukraine Alliance, your entry into the Ukrainian market will be efficient and legally compliant. We guide you through the entire formation process and reduce the administrative effort for you to a minimum.

Please feel free to contact us: n.horvath@german-ukraine-alliance.com – +49 (0)7221 - 4099014

Introduction to company formation in Ukraine

Ukraine offers an attractive environment for companies looking to expand their business activities. Establishing a limited liability company (LLC) is the most common practice for foreign companies looking to expand their business in Ukraine. The LLC offers more advantages than other legal forms as it requires limited liability of shareholders, a flexible corporate structure and a low minimum capital. This has made it the preferred choice for many companies.

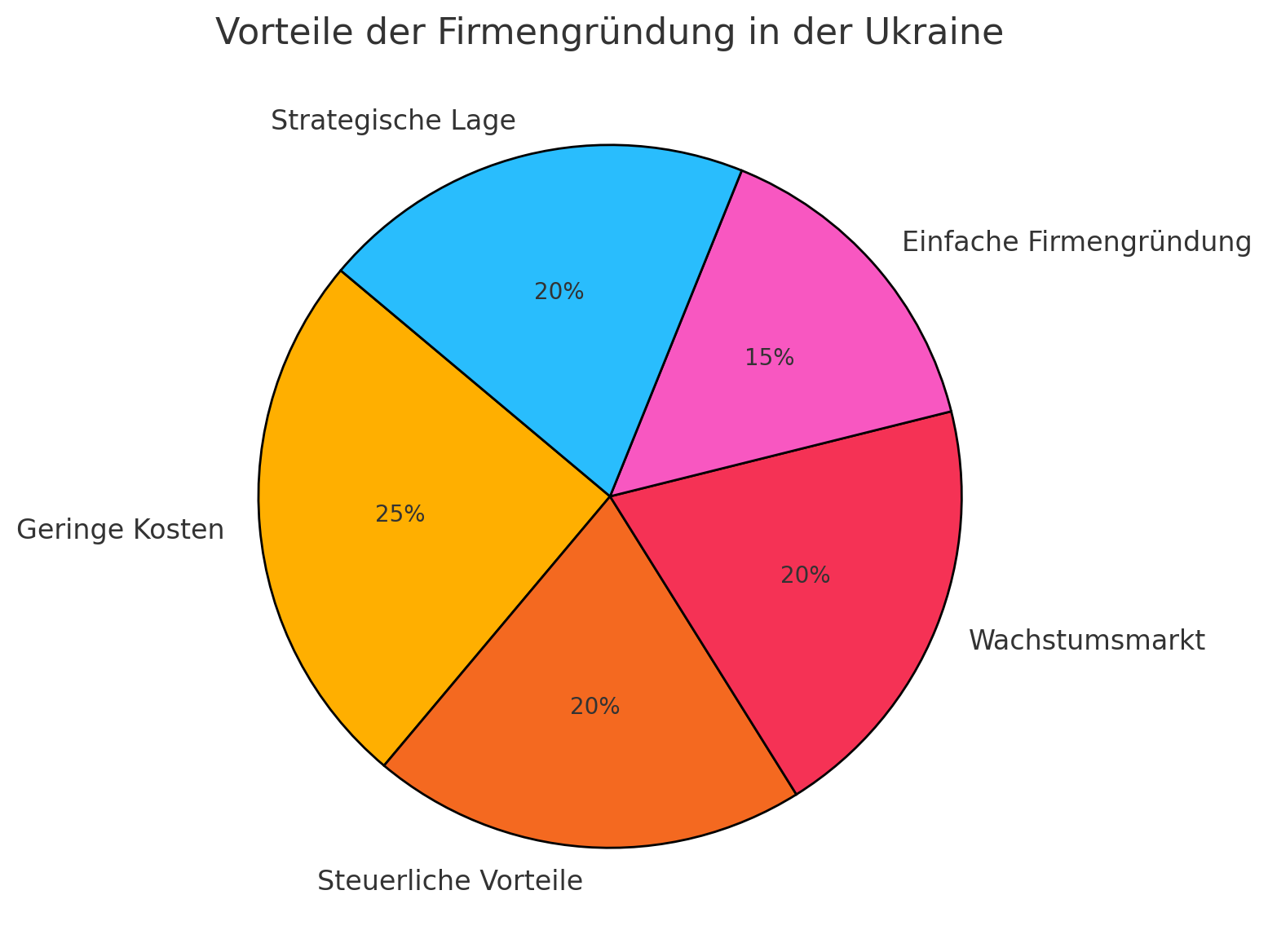

The pie chart shows the main advantages of setting up a company in Ukraine and illustrates why entrepreneurs should choose this location:

- Low costs (25%) - Setting up a company is comparatively inexpensive, with low start-up and operating costs.

- Tax advantages (20%) - Companies benefit from an attractive corporate tax rate and other tax incentives.

- Growth market (20%) - Ukraine offers great potential in emerging sectors such as IT, renewable energies and agriculture.

- Simple company formation (15%) - The registration process is fast and can be completed within 24 hours in optimal cases.

- Strategic position (20%) - Ukraine is an important link between the EU and Asian markets.

Which legal form is the right one for setting up a company in Ukraine?

The most common choice for foreign investors is the limited liability company (TOV), which corresponds to the German GmbH. Ukraine has a specific legal framework for limited liability companies, which can influence the structure and number of shareholders. It offers:

- Limited liability: Shareholders are only liable for their capital contribution.

- Flexibility: One or more founders can set up the company.

- Low minimum capital: The capital contribution can be made from just a few euros.

Another reason for the popularity of the GmbH in Ukraine is that no minimum capital is required and the formation costs are relatively low.

Alternatively, there is the OOO (general partnership), joint stock companies or sole proprietorships, although these legal forms are used less frequently.

Foundation of a Ukrainian limited liability company

The establishment of a limited liability company (TOV), the Ukrainian equivalent of a limited liability company, is the most common legal form for foreign investors. Although registration is theoretically possible within 24 hours, in practice the entire process (including applying for a tax number, registration, opening an account, VAT registration if applicable) usually takes 2 to 5 working days or even longer.

The company can be founded by the foreign investor personally or by a legally authorized representative. The power of attorney can be issued both abroad and in Ukraine and may have to be notarized and apostilled or consular legalized.

The biggest hurdles when setting up a company

- Complex registration and administrative procedures The registration of a limited liability company in Ukraine requires numerous documents, including articles of association, power of attorney, tax number and signatures of the shareholders. Notarizations and translations are also required.

- Our solution: We take care of the entire registration process, the translation of all important documents and dealing with the Ukrainian authorities.

- Tax and legal provisions Without knowledge of Ukrainian tax laws and the legal framework, companies can quickly get into difficulties. The rights of shareholders, such as the right to withdraw from the company and the right of first refusal when transferring shares, are particularly important. In addition, the requirements for foreigners, nationals and residents differ. Various types of contributions, such as cash and rights such as land and water use rights and property rights, can be used as share capital.

- Our solution: Our partners will provide you with comprehensive advice on taxes, formation costs, administrative details and all legal issues.

- Bank account and legal requirements Many banks require a residence permit or a work permit for foreign directors to open a business account. Alternatively, a Ukrainian managing director can be temporarily appointed to open the account.

- Our solution: We support you in applying for a work permit, clarify bank-specific requirements and help with the interim managing director solution, if necessary.

Managing director and shareholder

The shareholders of a Ukrainian LLC participate in the management of the company and in the distribution of profits. The shareholders' meeting is the highest body of a Ukrainian limited liability company and decides on all matters relating to the company's activities. The managing director is accountable to the shareholders' meeting and the supervisory board. At the time of registration of a limited liability company, a Ukrainian national must be appointed as managing director. Alternatively, an interim managing director can be appointed until a foreign person has obtained a work permit. There may also be exceptions under certain circumstances, depending on the legal situation and company structure. A foreign person can only be appointed as managing director after a residence permit has been issued.

CONCLUSIONS: A Ukrainian national must only be appointed as a managing director on a temporary basis if the foreign managing director does not yet have a work permit. As soon as the work permit is issued (usually within 7 working days), a foreign person can be formally appointed as managing director.

Costs and taxes when founding a company

There are generally no state fees for registering a TOV. Notary fees vary depending on the region and the number of documents to be notarized; for example 400 UAH per signature should be regarded as a rough guide (however, the region and scope may cause considerable deviations).

The taxation of the economic activity of a limited liability company in Ukraine is complex and subject to various laws and regulations. The corporate income tax rate is currently 18 %, while the value added tax (VAT) is 20 %. There is a simplified tax system with reduced rates for smaller companies. There are also tax incentives for certain sectors, particularly in the IT and export industries.

CONCLUSIONS: The general corporate income tax rate in Ukraine is 18 % for regularly taxed companies. Excluded of which are financial institutions (except insurance companies): their corporate income tax was calculated at January 1, 2025 to 25 % increased .

Companies with a small turnover can use the Simplified tax system use: 5 % of turnover (incl. VAT) or 3 % (excl. VAT)depending on VAT status and income level.

IT companies can help the Diia City Program a special legal and tax regime with attractive benefits:

- Choice of regular system (18 % corporation tax) or a special rate of 9 % on withdrawn capital

- Reduced tax rates apply for employees: 5 % Income tax, 1.5 % (now 5 %) Military taxas well as contributions based on minimum wage regulations.

Successful company formation in Ukraine with the German Ukraine Alliance

We take care of the time-consuming procedures and administrative procedures so that you can concentrate on your core business.

Please feel free to contact us: n.horvath@german-ukraine-alliance.com – +49 (0)7221 - 4099014