Ukrainian tax law is subject to continuous reform in order to promote investment. German companies should regularly inform themselves about the current tax framework in order to better assess potential benefits and risks. German companies in particular that wish to invest or open a branch in Ukraine should inform themselves about the tax framework. Due to the current geopolitical situation and the changing legal situation, tax adjustments are possible at short notice. Ukraine's tax law is subject to ongoing reforms aimed at making the country more attractive for investors. Companies and private individuals who are economically active in Ukraine should therefore regularly inform themselves about the applicable regulations. Immerse yourself in the topic of Ukrainian tax with us.

Tax law principles

Tax law in Germany and Ukraine is based on various legal sources, each of which contains specific rules and regulations. In Germany, these are the Income Tax Act, the Corporate Income Tax Act and the Value Added Tax Act. These laws form the foundation of German tax law and regulate the taxation of income, companies and sales.

In Ukraine, on the other hand, the Tax Code, the Customs Code and the Ukrainian Constitution are the central sources of law. The Tax Code of Ukraine contains comprehensive provisions on the various types of tax and their collection. The Customs Code regulates aspects of customs law, while the Constitution sets out the basic principles of tax law.

These tax law principles are particularly important in order to understand the tax measures to support those affected by the war. They provide the legal framework within which tax relief and support measures can be implemented. Companies and private individuals should therefore familiarize themselves with these principles in order to better understand the current tax regulations and their effects.

Important types of tax in Ukraine

In Ukraine, there are a total of 19 nationwide and four regional Ukraine tax types. The most important taxes are

- Corporate income tax

- Value added tax (VAT)

- Income tax

- Social security tax

- Special military levy

- Excise tax

- Real estate tax

- Environmental tax

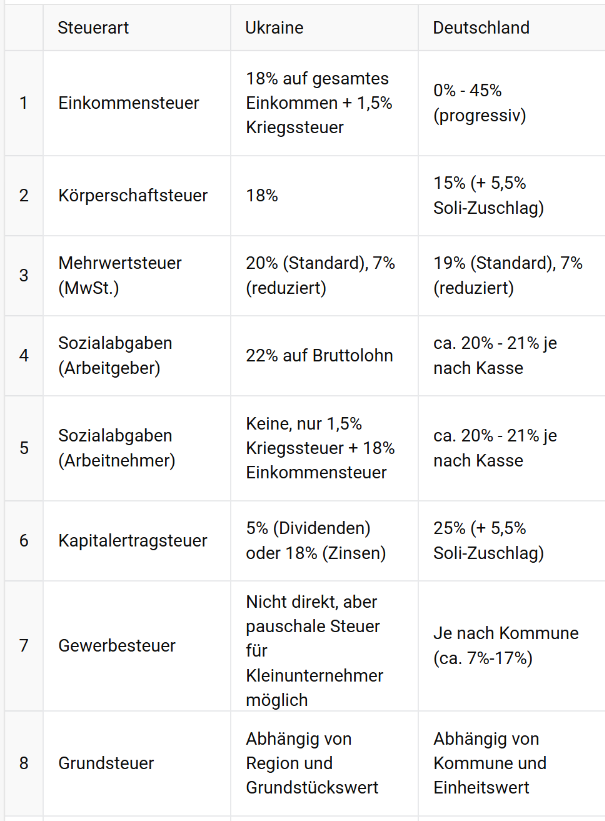

Comparison: German vs. Ukrainian taxes

In order to provide German companies with better orientation, we have created a compact comparison with practical examples for Ukraine tax. Please note the status 2/2025.

1. corporate income tax

- Germany15 % + 5.5 % solidarity surcharge (effectively approx. 15.83 %)

- Ukraine: 18 %

- ExampleA mechanical engineering company with a profit of €1,000,000 pays approximately €158,300 in Germany and €180,000 in Ukraine in corporation tax.

2. trade tax

- GermanyDepending on the municipality 7 % to 17 %

- UkraineNo own trade tax

- ExampleA trading company with a profit of €500,000 pays around €50,000 trade tax in Munich, but this is not applicable in Ukraine.

3. sales tax (value added tax)

- Germany19 % (reduced 7 %)

- Ukraine20 % (reduced 7 % or 14 %)

- ExampleA German IT company sells software for €10,000, of which €1,900 is VAT. In the Ukraine it would be €2,000 VAT.

4. income tax

- GermanyProgressive tax rate from 14 % to 45 %

- Ukraine: Uniform 18 %, dividends with 5 %

- ExampleA managing director with a salary of €100,000 pays around €42,000 income tax in Germany and €18,000 in Ukraine.

5. social security contributions

- GermanyEmployer approx. 20 %, employee approx. 20 %

- UkraineEmployer 22 %, employee no tax

- ExampleA company pays € 600 in social security contributions for an employee with a gross salary of € 3,000 in Germany and € 660 in Ukraine, but the employee pays nothing.

6. real estate tax

- GermanyVaries depending on the municipality, usually 0.35 % of the assessed value

- Ukraine: Up to 1.5 % of the minimum wage per square meter

- ExampleAn office with 100 m² in Berlin is taxed at 0.35 % of the unit value, in Kiev it could be around 12,000 UAH (approx. 300 €) with a minimum wage of 8,000 UAH and 1.5 % tax.

This comparison shows that the tax burden in Ukraine is lower in some areas than in Germany. For IT companies in particular, the Diia City regime tax advantages.

Please note that this comparison is a general overview and does not replace tax or legal advice. For an individual assessment, we recommend consulting a tax advisor.

Corporate income tax

The corporate income tax in Ukraine is 18 % and is levied on the income of companies that are resident for tax purposes in Ukraine or are economically active there. Germany and Ukraine have concluded a bilateral double taxation agreement (DTA) in order to avoid double taxation of companies. Among other things, this agreement regulates how profits of German companies operating in Ukraine are treated and which tax relief can be claimed. A withholding tax rate of 15 % applies to foreign companies that generate profits in Ukraine.

For example, a German engineering company that opens a branch in Kiev must pay 18 % on its profits made in Ukraine.

There are special regulations for investors in Ukraine tax: Large investments of 12 million euros or more can be exempt from paying corporation tax under certain conditions. In addition, IT companies are exempt from paying corporation tax under the Diia City Regimes a reduced tax rate of 9 % on investment income.

Germany and Ukraine have concluded a bilateral double taxation agreement (DTA) in order to avoid double taxation of companies. Among other things, this agreement regulates how profits of German companies operating in Ukraine are treated and which tax relief can be claimed. A withholding tax rate of 15 % applies to foreign companies that generate profits in Ukraine. For example, a German engineering company that opens a branch in Kiev must pay 18 % on its profits generated in Ukraine.

Value added tax

For example, a German software company that sells digital services to Ukrainian customers must register for VAT and pay 20 % VAT on its sales. VAT in Ukraine is generally 20 % and is set out in the Ukrainian Tax Code. German companies that are economically active in Ukraine or offer goods and services must register as foreign VAT payers under certain conditions. This applies in particular to companies that provide digital services to Ukrainian consumers or operate a permanent establishment in the country. Registration is carried out via the competent tax authority and specific proof is required. However, there are reduced rates:

- 14 % for certain agricultural products

- 7 % for pharmaceutical products

Companies with a turnover of more than 1 million hryvnia in the last 12 months are obliged to register as VAT payers. Foreign providers of digital services are also subject to VAT. As you can see, the issue of Ukraine tax is not entirely straightforward.

Flat-rate taxation

In Ukraine, small companies and sole traders can use the Flat-rate taxation to simplify their tax burden. This form of Ukrainian tax replaces several types of tax with a flat-rate levy, significantly simplifying tax returns and payments.

Taxpayers in Ukraine are divided into different groups, with taxation varying according to company size and annual turnover:

- Group 1For sole traders who exclusively provide services to private individuals and have an annual turnover of no more than UAH 300,000. They pay a fixed tax based on their business operations.

- Group 2For sole traders who sell goods and services to private individuals or are commercially active with an annual turnover of up to UAH 1.5 million. You pay a flat-rate tax based on your turnover.

- Group 3For larger sole traders with an annual turnover of up to UAH 5 million (approx. EUR 125,000). You pay a flat-rate tax based on turnover and are exempt from VAT.

Flat-rate taxation exempts companies from the obligation to pay income tax, VAT and social security contributions, so that only a single tax is payable, which varies depending on the level of turnover. This regulation is intended to promote small companies, which often cannot devote large administrative resources to complex tax returns.

Income tax

Individuals in Ukraine pay income tax of 18 % on their income. A German manager who works for a subsidiary in Ukraine and receives his salary there must pay income tax of 18 % on this income as well as an additional military tax of 1.5 %. Individuals in Ukraine pay income tax of 18 % on their income. In addition, a Military levy of 1.5 % is levied. A reduced rate of 5 % applies to income from dividends, while non-residents have to pay 9 % on capital gains.

Social security tax

The social security tax is 22 % of the gross salary. A reduced rate of 8.41 % applies for people with disabilities. The maximum amount of social insurance is limited to 15 times the minimum wage.

Real estate tax

The real estate tax in Ukraine is determined by the local authorities and varies depending on the region and type of property. However, it may not exceed 1.5 % of the minimum wage per square meter are. This means that companies can expect different tax burdens depending on the location and use of their real estate. It is therefore advisable to carry out a tax analysis before making an investment. For example, a German company that owns an office building in Lviv may have to pay up to 1.5 % of the minimum wage per square meter as tax, depending on the region.

For example, the Ukrainian minimum wage has been as follows since January 1, 2025 8,000 hryvnia per month. If the tax authorities exceed the maximum rate of 1.5 % of the minimum wage per square meter the real estate tax for a 100-square-meter office would be calculated as follows:

8,000 hryvnia × 1.5 % = 120 hryvnia per square meter

100 m² × 120 hryvnia = 12,000 hryvnia per year in real estate tax for the office.

(Exchange rate: 1 EUR ≈ 40 Hryvniaas of February 2025)

Support from the German-Ukraine Alliance for Ukraine Tax

The German-Ukraine Alliance offers a comprehensive overview and support for German companies wishing to invest or open a branch in Ukraine. This includes:

- Placement of experienced tax consultants and accountants with expertise in Ukraine

- Provision of up-to-date information on tax changes due to martial law

- Support in applying for subsidies and tax relief in cooperation with local tax consultants.

- Personnel recruitment

- Support with permits and authorities

Best tax opportunities for investments in Ukraine

The optimal tax strategy for German companies depends heavily on the respective business area:

- Production and manufacturing: Companies with their own production facilities can benefit from tax incentives such as investment subsidies and special zones. Large investments of 12 million euros or more can be exempt from corporation tax under certain conditions.

- IT and technologyIT companies can apply for the Diia City regime which offers a reduced tax rate of 9 % on capital gains and thus enables considerable tax savings.

- Trade and servicesTrade and service companies should check whether they are eligible for lump-sum taxation in order to minimize administrative requirements.

- Real estate and constructionInvestors in real estate should note the regional differences in real estate tax, as it can be up to 1.5 % of the minimum wage per square meter, depending on the location.

Please note that we do not offer tax or legal advice. However, we can provide qualified tax advisors and accountants in Ukraine who can provide you with individual support.

Tax measures to support those affected by the war

The Ukrainian government has taken various tax measures to support people who have suffered as a result of the war. These measures are set out in various BMF letters and tax regulations and are aimed at reducing the economic burden on those affected.

The most important measures include the simplification of tax procedures, the reduction of taxes and the granting of tax relief. For example, certain deadlines for filing tax returns have been extended to give those affected more time. In addition, tax rates for certain income and companies have been lowered in order to reduce the financial burden.

These measures are designed to help people in Ukraine who have been affected by the war quickly and unbureaucratically. Companies and private individuals should inform themselves about the current regulations in order to take advantage of the available relief.

BMF letter and tax regulations

The Federal Ministry of Finance (BMF) has published various letters and tax regulations to implement the tax measures to support those affected by the war. These BMF letters contain important information on the tax regulations and the application of the measures.

The BMF circulars provide detailed instructions on how the tax relief and support measures are to be implemented in practice. They provide clear guidelines for the tax authorities and taxpayers to ensure that the measures are applied correctly.

It is important to take note of these BMF letters and tax regulations in order to correctly apply the tax measures to support those affected by the war. Companies and private individuals should regularly inform themselves about new BMF circulars in order to stay up to date and make optimum use of the available relief.

Special regulations Ukraine tax

In addition to the general tax measures, there are also various special regulations that apply specifically to support for victims of war. These special regulations are set out in the BMF letters and tax regulations and can vary depending on the situation.

The special regulations include, for example, special tax relief for companies in particularly affected regions or for certain types of income. These regulations are intended to ensure that support is targeted and effective where it is most urgently needed.

It is important to observe these special regulations and apply them correctly in order to make the best possible use of the tax measures to support those affected by the war. Companies and private individuals should therefore regularly inform themselves about the current regulations and, if necessary, seek professional advice in order to make the best possible use of the available relief.

Special tax features due to martial law

Due to the war and martial law in Ukraine, the tax situation can change quickly. Temporary tax relief is possible, particularly for companies in crisis regions or war-related adjustments to tax rates.

German companies operating in Ukraine or planning to expand should follow regular updates from the Ukrainian tax authorities and international chambers of commerce. They can also seek advice from local tax consultants and auditors in order to be prepared for short-term changes.

Support is provided by the German-Ukrainian Chamber of Industry and Commerce and the Federal Ministry of Economics and Climate Protection, among others, which provide information on tax adjustments and support programs. EU funding programmes or international organizations can also provide financial relief.

Current tax developments and legal changes are regularly available on the websites of the Ukrainian tax authorities and relevant economic institutions. Companies should use these sources to stay up to date. Due to martial law in Ukraine, the tax situation can change quickly. Companies should regularly inform themselves about possible tax relief, especially for crisis regions. Up-to-date information is available on the websites of the Ukrainian tax authorities and relevant economic institutions.

Need for an accountant for companies in Ukraine

In Ukraine, it is a legal requirement that every registered company or branch office must have its own accountant. This means that German companies opening a subsidiary or permanent establishment in Ukraine must either hire an in-house accountant or hire an external accounting service provider. This is crucial to ensure compliance with Ukrainian tax laws and avoid potential penalties.

Conclusion on the article Ukraine tax

Ukraine's tax law remains dynamic and is constantly being reformed, particularly in the context of current geopolitical developments. German companies should turn to tax consulting firms with expertise in Ukraine to minimize tax risks and ensure sound planning. It is important for investors and companies to keep abreast of current developments in order to benefit from potential relief and minimize tax risks. It is advisable to seek tax advice in order to make the most of the latest regulations.

You need help with your expansion into Ukraine - arrange a non-binding appointment.